A Joint G7 and V20 Ambition: Working towards a Global Shield against Climate Risks

Updated as of 25 October 2022

- Climate-fueled risks have driven up the cost of capital and debt to unsustainable levels, especially across climate vulnerable economies, worsening financial protection gaps. Increasing pre-arranged finance which disburses quickly and reliably before or just after disasters happen, and expanding instruments of financial protection for governments, communities, businesses, and households can lower the impact of disasters, make vulnerable countries’ economies more resilient, safeguard sustainable development, and protect lives and livelihoods of poor and vulnerable people.

- The G7 in partnership with the Vulnerable Twenty Group (V20) of Finance Ministers from the most climate vulnerable countries want to help close the protection gap for poor and vulnerable people against climate-related losses and damages.

- Critical to the Global Shield’s success is the building of local and regional risk markets across climate vulnerable economies and to build local and regional institutional resilience.

- The Global Shield is not the only response needed to addressing loss and damage – it aims to make considerable and effective progress towards providing and facilitating more and better pre-arranged protection against climate and disaster related risks.

- New and additional resource mobilization is critical to the success of the Global Shield, going beyond current ODA targets.

Leadership of V20 and the G7

21 April 2022

“[…] Closing the financial protection gap through the creation of an adequately-resourced, centralized and coordinated G7 presidency-initiated Global Shield for financially protecting against climate-related losses and damages. The Global Shield as a centralized mechanism for adaptation and resilience can build domestic, regional and international markets in order to avert, minimize and address losses and damages is important to strive for. We will all be better off because we can build a market to handle these risks in a highly effective way and to encourage a system that delivers the objective of resilience to economies and climate justice to communities. […]”ent institutions’ and donors’ efforts at the global, regional and national level.

19 May 2022

“[…] We are committed to working with partners outside the G7 to further strengthen the global CDRFI architecture so it becomes more systematic, coherent and sustained, and will work towards a Global Shield against Climate Risks. […] We will work with the IGP to build a strong coordination mechanism for CDRFI and call upon the InsuResilience Solutions Fund and the WB Global Risk Financing Facility to contribute by identifying and covering protection gaps and supporting a wide range of partners.”

28 June 2022

“We recognise the urgent need for scaling-up action and support to avert, minimise, and address loss and damage particularly in vulnerable developing countries. We commit to scale up climate and disaster risk finance and insurance (CDRFI) and will work towards a Global Shield against Climate Risks, building on the InsuResilience Global Partnership and other initiatives. We ask our Development Ministers to make progress on the Global Shield by COP 27.”

16 October 2022

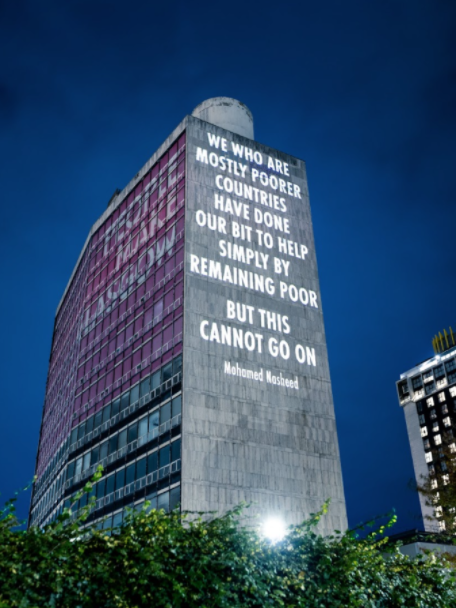

Closing the Financial Protection Sinkhole

We are determined to close the 98 percent (%) V20 financial protection gap – a massive economic fissure, a sinkhole – against climate risks principally through the G20/V20 InsuResilience Global Partnership and, its successor, the G7/V20 Global Shield against Climate Risks as critical financial protection cooperation, including through premium subsidies towards building domestic and regional markets through the Sustainable Insurance Facility, and for the key vehicles to always act in the best interest of their ultimate clients, the climate vulnerable countries and particularly LDCs and small island states. The implementation of the Sustainable Insurance Facility for enterprises and supply chains, and the Global Risk Modelling Alliance for risk analytics and modelling, are central to addressing the private financial protection fissure across V20 member states. Equally important is to reduce indebtedness through the course-correction of instruments that drive indebtedness post-disaster or are expensive relative to other disaster risk financing options for LDCs, SIDSs and emerging economies, such as Catastrophe Bonds.

The call by vulnerable countries within and outside UNFCCC for an adequate response to the climate crisis is loud and clear. In partnership with the V20, the G7 therefore committed to jointly work towards a Global Shield against Climate Risks. The Global Shield (GS) will start delivering soon and contribute to the international efforts to avert, minimise and address climate-related losses and damages.

The GS builds on recent years’ substantial progress on enhancing financial protection against climate-related disaster risks for poor and vulnerable people and countries. Through the joint efforts under1 the V20/G20 InsuResilience Global Partnership (IGP), which builds on the G7 InsuResilience Initiative (Elmau 2015), 150 million poor and vulnerable people benefited from climate and disaster risk finance and insurance (CDRFI) solutions in 2021 alone.

However, funding for disaster response and recovery is still mainly arranged ex-post. Thus, important time to save lives and livelihoods is lost and the cost of disasters and their impact increases. Moreover, climate-fuelled risk has driven up cost of capital and unsustainable debt levels across climate vulnerable economies, which has contributed to worsening financial protection gaps.

We have to address climate impacts by swiftly redesigning existing structures to deliver for impacted vulnerable countries and people. More and better CDRFI can lower the impact of disasters, make vulnerable countries’ economies more resilient, and protect lives and livelihoods of poor and vulnerable people. This includes instruments which pre- arrange finance at the government level, providing quick and reliable funding when disasters happen, and instruments of financial protection for communities, businesses, and social protection schemes for households.

Senegal

Senegal is heavily affected by recurring droughts. Complementary coverage through sovereign insurance, corporate risk transfer and microinsurance helps responding to drought-related food crises. In 2020, the government received a payout of US$ 12.5 million from the African Risk Capacity (ARC). The payout was complemented by support through the Start Network of additional US$ 10.6 million. In 2021, more than 8 million vulnerable people in Senegal were insured against climate risks.

Vision and Objectives of the Global Shield

The GS will increase protection for poor and vulnerable people by substantially enhancing pre-arranged finance, insurance and social protection mechanisms against disasters. Greater financial protection, and faster and more reliable disaster preparedness and response, will help to cost-efficiently and effectively minimise and address losses and damages exacerbated by climate change.

To achieve its objective, the GS will close urgent protection gaps in countries by designing, funding, and facilitating interventions. All interventions will be based on national ownership. The GS will ensure more systematic, coherent, and sustained financial protection through the following building blocks:

Strengthened coordination within the global CDRFI architecture across G7, V20 and other climate vulnerable economies to ensure coherence of different institutions’ and donors’ efforts at the global, regional and national level.

A global, flexible, and collaborative financing structure to mobilise and pool respective donor and other funds and enable a more systematic global approach to closing protection gaps.

Sustained protection in the face of increasing climate risks by scaling up existing successful CDRFI programmes and preparing country-specific, needs-based CDRFI support packages, including the scaling up of smart premium and capital support to address affordability barriers.

How the Global Shield Will Work

- Countries will lead on identifying key protection gaps.

Starting with a systematic analysis of countries’ protection gaps, the GS will facilitate instruments designed to provide rapid financial relief directly to households and businesses to respond to disaster-related losses, or instruments which pre-arrange finance for governments, humanitarian agencies, and non-governmental organisations for disaster preparedness and rapid response. This will also entail strengthening and building shock-responsive social protection systems and other delivery systems to ensure that pay-outs are spent on providing what affected individuals and communities need when they need it the most.

Depending on a country’s readiness for these instruments, the GS will facilitate different types of support from various sources to help countries access the needed instruments sustainably. Technical assistance will be available to support policy reforms, CDRFI strategies, strengthened regulatory frameworks, and capacity building. Financial assistance will be available to build in- country systems like adaptive social safety nets, capitalise risk carriers, and (co)finance insurance premiums. In addition, the private sector will be mobilised to deliver risk analytics, design products and triggers, and underwrite respective risk transfer solutions.

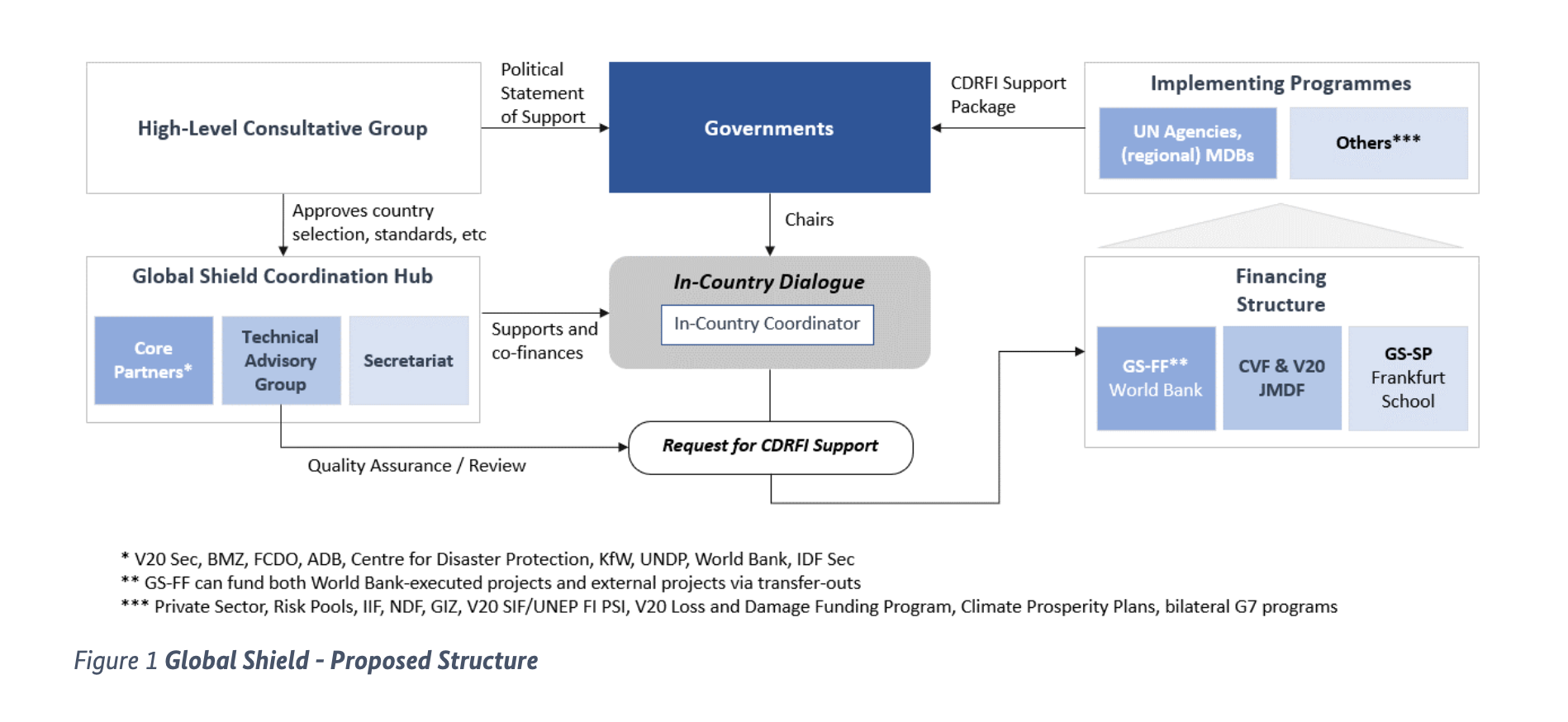

Proposed Structure of the Global Shield

It is the explicit aim to minimize the creation of new institutions and to instead build as much as possible on existing structures. However, in order to deliver on the GS’s objective in a timely, inclusive and efficient manner, existing structures and contributing partners will need to be reformed, endowed with broader mandates and include a wider range of stakeholders. The GS is proposed to consist of the following elements:

Political guidance and oversight provided by the GS High-Level Consultative Group (HLCG, based on the IGP HLCG). In addition to the current HLCG set-up, further donors of the Global Shield Financing Structure and additional vulnerable countries may join the HLCG.

Overarching technical work, global coordination beyond country-specific dialogues and preparation of decisions for the GS HLCG by the GS Coordination Hub. The Coordination Hub consists of the reformed IGP Program Alliance (PA) and is supported by the GS Secretariat (strengthened IGP Secretariat) and a Technical Advisory Group (TAG). PA membership will be expanded to become more inclusive.

Identifying country-specific CDRFI needs, gaps and options of interventions / instruments through inclusive in-country-dialogues under the leadership of host countries. Country dialogues will aim at crowding in and leveraging existing and additional CDRFI support from a wide range of partners and identify remaining support gaps in view of arriving at comprehensive country protection packages.

Covering support gaps through additional GS-focused financing provided through a central GS Financing Structure with a single entry point encompassing three complementary vehicles: the Global Shield Solutions Platform (GS-SP) (building on the InsuResilience Solutions Fund and hosted by Frankfurt School), the reformed Global Shield Financing Facility (GS-FF, the reformed Global Risk Financing Facility (GRiF)) hosted by the World Bank, and the CVF & V20 Joint Multi-Donor Fund (V20 JMDF). The three will supplement existing CDRFI programmes and finance urgent protection gaps by channelling funding to governments, implementing organisations, private sector, non-governmental organisations, and humanitarian agencies led by GS standards and decision making.