V20 Views on the NCQG on CF on post-2025

We take with utmost seriousness the opportunity to share our views concerning the composition of finance under the New Collective Quantified Goal (NCQG) on Climate Finance beyond 2025. We will only compound the problem if the approach we take is overly broad and excessively concerned with ultimate global totals of mobilized finance. We are in a period when specificity of circumstances become fundamental if not central to realizing actual outcomes derived from the NCQG agenda.

In fact, the V20 Group of Finance ministers was established in October 2015 precisely to lend unique expertise on such matters.

The V20 Finance Ministers of the Climate Vulnerable Forum (referred to as the CVF-V20) is a dedicated cooperation initiative of economies systematically vulnerable to climate change. It is currently chaired by the Republic of Ghana. The V20 Finance Ministers membership stands at 68 economies representing some 1.74 billion people and 6.55 percent (equivalent to USD 3.8 trillion) of global GDP. The V20 was formed to translate climate-driven political outcomes into real economy investments and domestic strategies.

There are several areas this collective effort need to dwell on:

First, despite V20 economies representing 21.5 percent of the global population, the V20 accounts for around 4 percent of global greenhouse gas emissions. And yet a V20 study on climate losses estimates V20 economies have lost some $525 billion over the last twenty years (2000-2019) due to the impact of climate change on temperature and precipitation patterns. In other words, the V20 countries and their people would have been 20% wealthier today if not for climate change.

Second, we need to understand the dynamic between climate and debt. We either make debt work for the climate or we will reinforce the deadly downward spiral we are currently in. The V20’s Accra-to-Marrakech Agenda (A2M) shares perspectives on a successful international financial architecture reform, including to “make debt for the climate”.

The V20’s total external public and publicly guaranteed debt amounts to $946.7 billion. External debt servicing is expected to escalate to $122.1 billion in 2024. V20 members are expected to pay $904.7 billion in debt service over 2022-2030. Fiscal space is limited and V20 economies do not have breathing room. High levels of external sovereign debt across the group are directly crowding out the ability of these governments to make the investments that are required to achieve climate change and development goals. For this reason, the Group recommends the NCQG to focus on the composition of finance, including concessionality where public resources are utilised to ensure that the weighted average of the cost of capital is lower than the medium-term growth rate.

Reinsurance and insurance costs went up, driving up the cost of capital. This year, in 2024, we expect to have 30 named storms in one season in the Atlantic, more than the 2005 season which caused insurance models to change. Global property catastrophe reinsurance rates increased by up to 30% on January 1, 2024, for policies that had previously experienced losses. Reinsurance rates are now up by an estimated 76% since 2017.

A staggering 98 percent financial and social protection gap exists across climate-vulnerable economies. Pre-arranged and trigger-based solutions can be especially useful to reduce currency liquidity pressure for climate vulnerable economies in the face of the expected natural disasters.

The Group calls for concessional, long-term financing for climate change (e.g. 25-30 year loans at very low interest rates, local currency financing, etc.) to be supported by guarantees/credit enhancement/de-risking/debt solutions such as yearly debt-for-climate swaps, among others.

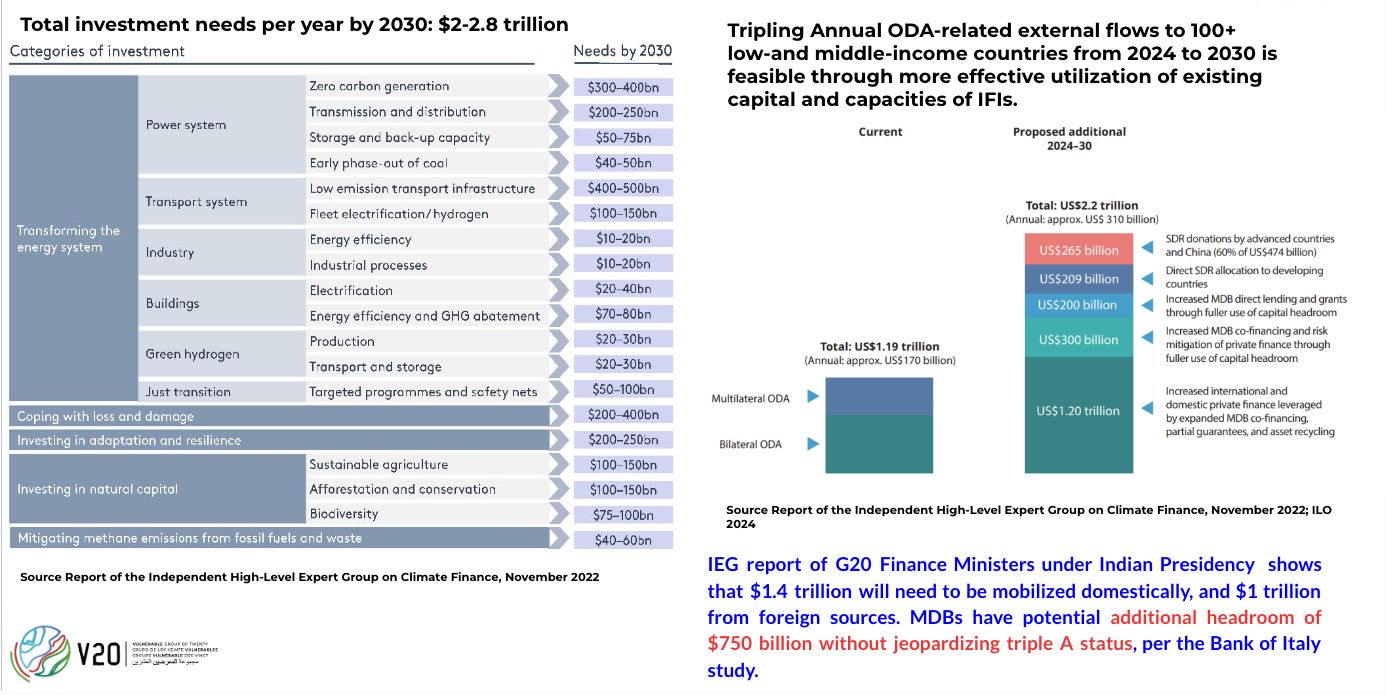

Multilateral development banks as the sources of long-term, low-cost financing have an important role to play in supporting our climate and development goals. MDBs will need to fully implement balance sheet optimization measures. Their shareholders need to equip them with additional resources through capital increases to ensure that they can achieve the scale of lending, with appropriate concessionality levels, as envisioned in the G20 Independent Expert Group report. MDBs should take into account climate vulnerability when devising their concessionality frameworks.

It’s also time to “make debt work for the climate” including for Debt Sustainability Analyses (DSAs) to incorporate real investment and spending needs and determine what it takes for each country to achieve them. Five key areas include:

- Reform of the sovereign debt architecture to ensure inclusive participation to involve all creditor classes and debtor governments including middle income countries;

- Rapid disbursement of financing as no country can afford to wait the usual 18-36 months for MDB financing;

- Affordable financing — and if it is on a country by-country basis then each country’s funding needs must be customized to ensure that its interest rate is lower than the projected medium-term growth rate;

- New financing must be sufficiently substantial to trigger growth and generate more revenue for investments and the liquidity required for debt sustainability; and

- Debt relief is directly commensurate with the climate change and development investment needs.

Reference Documents

- V20 Ministerial Dialogue XII Communique (link)

- 2nd edition of the V20 Debt Review (link)

- Accra-to-Marrakech Agenda (A2M) (link)

Prepared by: Sara Jane Ahmed, Abena Tayiwaa Asamoah-Okyere, Rishikesh Bhandary, Nilesh Prakash