CVF Leaders Convene in Davos to Drive Investments into Climate Prosperity

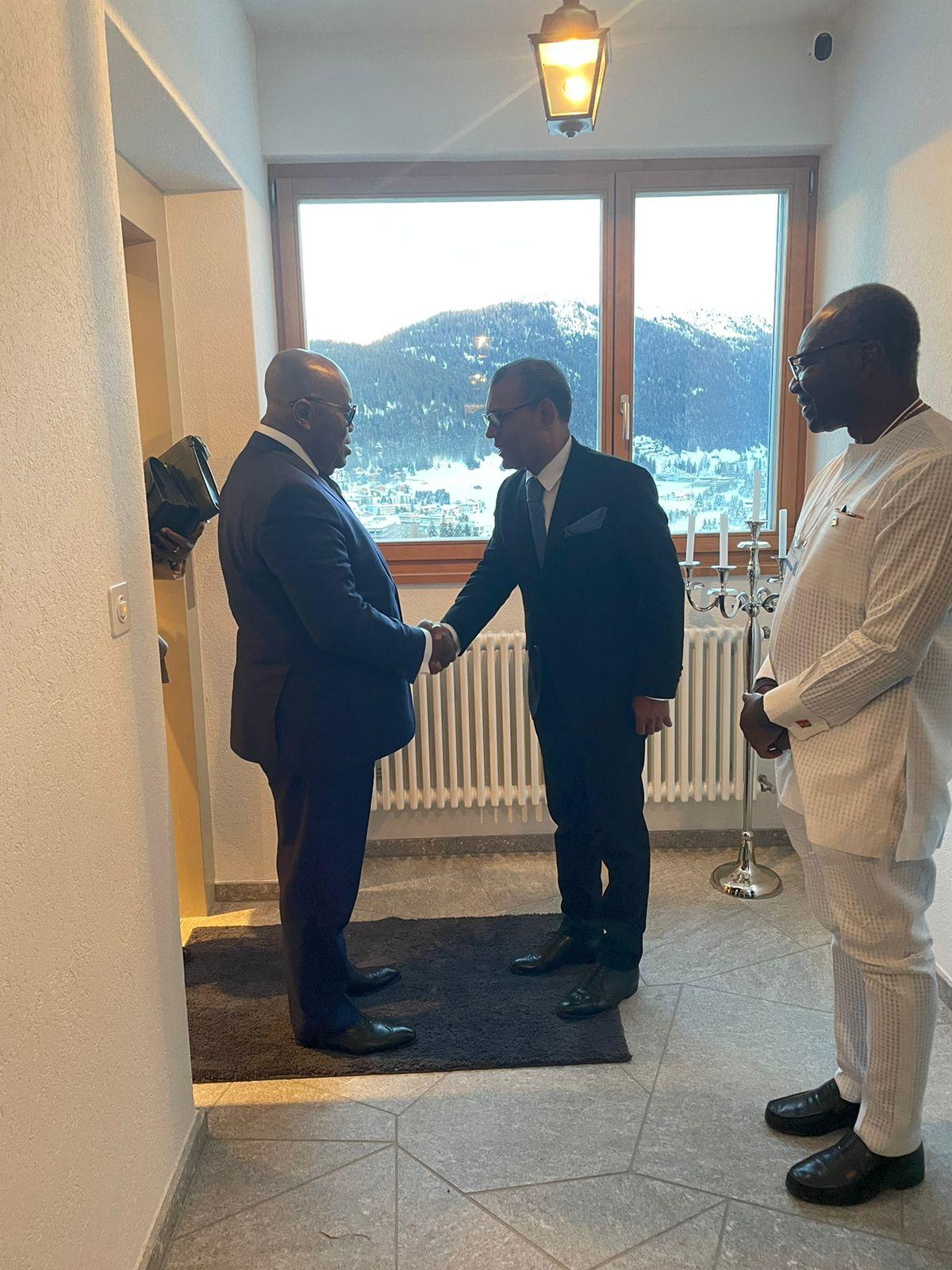

Davos – 16 January 2024 – In a landmark event, Climate Vulnerable Forum (CVF) heads of state, finance ministers, investors and key stakeholders convened in Davos, Switzerland to discuss resource mobilisation for CVF member countries’ Climate Prosperity Plans (CPPs). The CPPs are development-positive plans designed to deliver investments and prosperity in 68 member states of the CVF. Critical to the success of CPPs are catalytic deals to unlock capital investments in climate change projects.

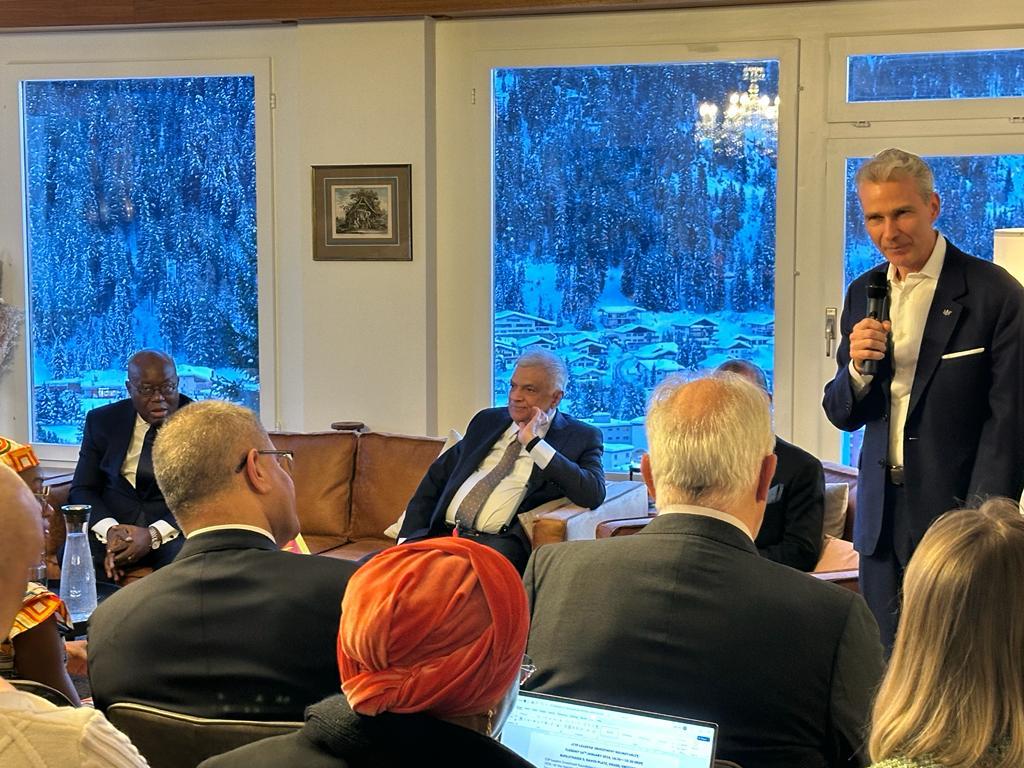

President of Ghana and Chair of the CVF, H.E. Nana Addo Dankwa Akufo-Addo, in his welcoming remarks emphasised the forum’s commitment to maintaining the 1.5-degree limit set by the Paris Agreement, highlighting the importance of CPPs in channelling investments toward sustainable socio-economic development through climate action. “The transformation of the CVF into an independent intergovernmental organisation in December 2023 stands as a monumental step towards fostering South-South cooperation and unlocking investment opportunities in our member states with CPPs as our blueprint. This shift allows for a greater influx of international investments into commercially viable and climate-resilient projects within the Global South.”

The event also featured remarks from H.E. Ranil Wickremesinghe, President of Sri Lanka, who highlighted key priorities under Sri Lanka’s Climate Prosperity Plan, the steps taken by the country in translating the project pipelines into real investment opportunities and how these can be done in a creative way. “We need to deliver the goal of delivering a just, sustainable, and prosperous future, in the context of resource constraints and ever-increasing climate impacts and to realise this goal and for a sustainable, climate-secure transition, we need investments in training, skills, and digital technologies for job expansion.”

The forum noted the need to address all forms of barriers in making CPP projects investible, especially through derisking and seeking candid views from financiers to ensure compliance with investor terms. V20 Chair, H.E. Ken Ofori-Atta, Minister for Finance, Ghana added that Ghana’s focus as articulated in their recently launched CPP was on the 10,000-megawatt renewable energy project, the Bui Dam Hybrid Solar Project and the Mini grids for off grid communities. “The successful implementation of our CPPs depends on active collaboration with the private sector and philanthropists to drive investment in domestic priorities and effective climate action. Addressing the high costs of climate investments will involve innovative mechanisms like the V20’s Accelerated Financing Mechanism, supported by businesses and philanthropic entities.”

The roundtable underscored the importance of innovative private funding, the value of South-South collaboration particularly in fostering local research capabilities to help CVF member states create robust models for tackling climate change and achieving sustainable growth, as well as the pivotal role of philanthropic organisations in derisking investments to unlock critical private capital for commercially viable climate initiatives. Also crucial was the consensus on effectively aligning government’s drive to safeguard the well-being of its citizens with the private sector’s desire for assured returns on their ventures.

In closing, the Secretary-General of the CVF-V20 emphasised the need to redefine the concept of risks in investment. He cautioned that without investments into the economies of developing nations, developing countries may be compelled to exploit their natural resources in a manner that detracts from global climate goals. This underscores the urgent need for sustainable investment strategies that align economic development with climate action.

The Davos roundtable, hosted by Henley & Partners, was the first of a series of high-level events aimed at unlocking finance for CPP investments in CVF member countries. It marked a significant step toward global climate action, with a unified call for financing sustainable investment strategies and a collaborative approach to tackling the climate crisis.

Ends.